The Dynamics and Opportunities of Global Forex Trading

In the world of investment, few markets are as dynamic as the foreign exchange (forex) market. With a daily trading volume that surpasses $6 trillion, forex trading offers unique opportunities for profit, diversification, and risk management. For those interested in this exhilarating field, utilizing tools like a global forex trading Crypto Trading App can enhance trading strategies and outcomes. This article delves into the fundamentals of global forex trading, its advantages, and strategies for success.

Understanding Forex Trading

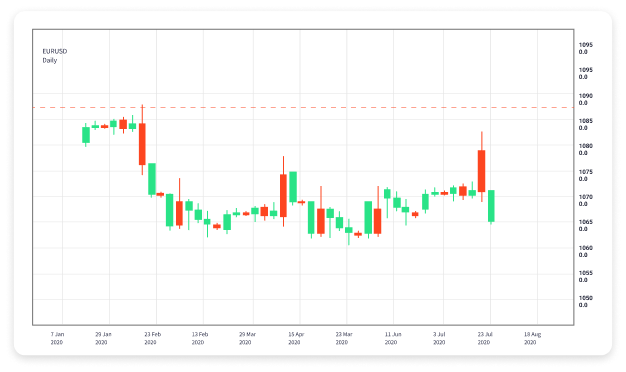

The forex market is the largest and most liquid financial market in the world. Unlike traditional stock exchanges, which operate during specific hours, the forex market functions 24 hours a day, five days a week, enabling traders to buy and sell currencies at any time. The primary objective of forex trading is to exchange one currency for another with the hope of making a profit. Currencies are traded in pairs, such as EUR/USD (Euro/US Dollar), meaning that when you buy or sell one currency, you are simultaneously buying or selling another.

The Structure of the Forex Market

The forex market consists of various participants, including central banks, financial institutions, corporations, hedge funds, and individual retail traders. Each participant has different motivations for entering the market, which can include hedging against currency risks, speculation, and profit-making. The market is decentralized, meaning that it does not have a central exchange. Instead, it operates through a network of banks, brokers, and electronic trading platforms.

Advantages of Trading Forex

One of the main advantages of forex trading is its high liquidity, which allows traders to enter and exit positions quickly without significant price changes. Additionally, the forex market offers high leverage, which enables traders to control larger positions with a relatively small amount of capital. This can amplify potential profits, though it also increases the risk of losses. Other benefits of forex trading include:

- Accessibility: Forex trading is accessible to anyone with an internet connection, allowing retail traders to participate alongside institutional investors.

- Variety of Trading Options: Traders can trade various currency pairs and financial instruments, including spot contracts, futures, and options.

- Low Transaction Costs: Forex trading often has lower fees than other markets, making it cost-effective for traders.

- Flexibility: Traders can engage in both short-term (day trading) and long-term (swing trading) strategies, depending on their risk tolerance and investment goals.

Key Strategies in Forex Trading

Success in forex trading requires a well-thought-out strategy. Here are some key strategies that traders often employ:

1. Technical Analysis

Many traders use technical analysis to make informed decisions. This approach involves analyzing historical price data and using chart patterns, indicators, and technical tools such as moving averages and Relative Strength Index (RSI) to forecast future price movements.

2. Fundamental Analysis

Fundamental analysis is another critical strategy where traders examine economic indicators, interest rates, and geopolitical events that can impact currency values. Keeping abreast of news and economic reports can provide insights into potential market shifts.

3. Risk Management

Effective risk management is essential for surviving in the forex market. This includes setting stop-loss orders, determining position sizes, and diversifying trading portfolios to mitigate risks associated with currency fluctuations.

4. Automated Trading

With the rise of technology, many traders now use automated trading systems or algorithms to execute trades automatically based on predefined criteria. This can remove emotional decision-making and enhance trading efficiency.

Common Mistakes to Avoid

While forex trading can be lucrative, it is not without its pitfalls. Here are some common mistakes traders should avoid:

- Over-leveraging: Using excessive leverage can result in significant losses. It is crucial to use leverage responsibly and understand the risks involved.

- Ignoring Market News: Failing to stay informed about economic events and news can lead to unexpected losses. Traders should regularly review economic calendars and financial news.

- Emotional Trading: Making impulsive decisions based on emotions can be detrimental. Developing a disciplined approach and sticking to a trading plan is essential.

- Neglecting Risk Management: Not implementing proper risk management strategies can expose traders to unnecessary risks. Always prioritize risk assessment in your trading plan.

The Future of Forex Trading

As technology continues to evolve, so does the forex market. The emergence of algorithmic trading, artificial intelligence, and advanced analytics are reshaping how traders approach the market. Furthermore, the growing popularity of cryptocurrencies is creating new opportunities and challenges for forex traders. Staying adaptable and open to new strategies will be essential for success in this ever-changing landscape.

Conclusion

Global forex trading offers unparalleled opportunities for those willing to educate themselves and develop effective strategies. By understanding market dynamics, utilizing proper tools, and implementing sound risk management practices, traders can navigate the complexities of the forex market successfully. As the financial landscape continues to evolve, remaining informed and adaptable will be key to thriving in this competitive arena.